I run my own business, how can I lower my tax bill? This question and the following response are so common that if feels like almost everyone is talking about it. Start an S-Corporation, do a little paperwork, and like magic you have saved thousands of dollars. A word to the wise, think twice and ask a professional for guidance before you start Do-It-Yourself tax planning.

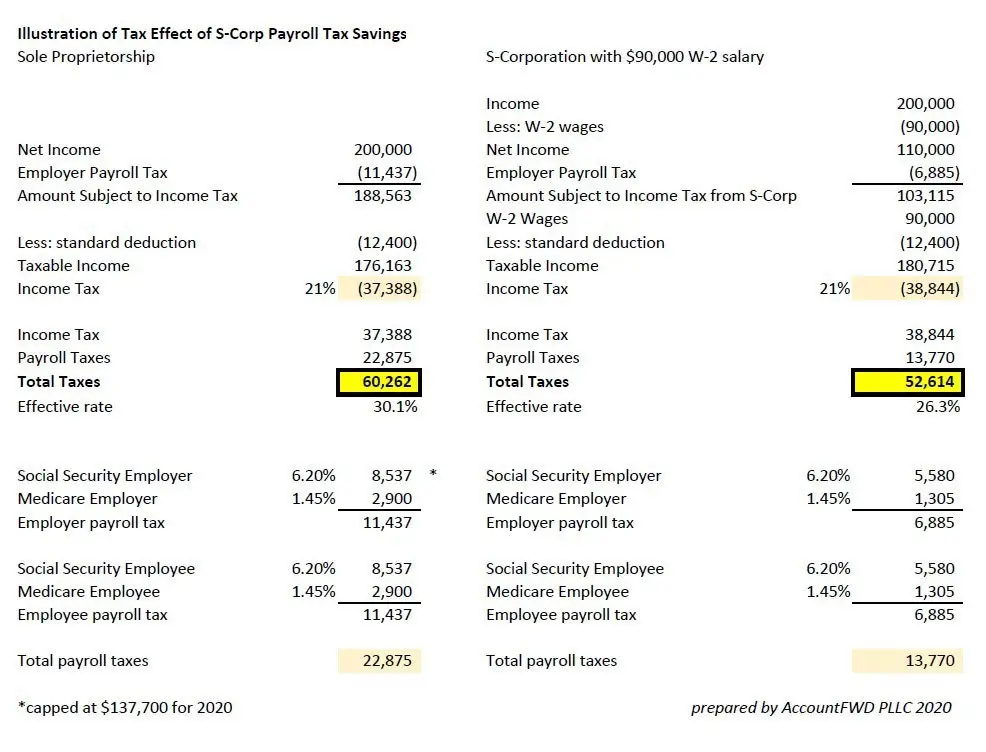

Here is how it works and later we will cover some of the risks. Let’s say you earn $200,000 and your business is wholly owned by you. You can report all income as a Sole Proprietorship or you can form an S-Corporation and report a portion of the income as wages and the remainder as distributions. Both options have similar income tax impact, the opportunity people talk about is in reducing the payroll tax.

There are two components to the tax calculation, self-employment tax (social security & medicare) and income tax. Self-employment tax is the same payroll tax everyone pays as an employee, social security and medicare. However when you are self-employed you get to pay both the employer and employee portions of this tax.

Social security is 6.2% up to $137,700 for both the employer and employee (total 12.4%) and medicare is 1.45% for both the employer and employee without a cap on wages (total 2.9%). We put together the illustration below which may help you see the numbers and the $7,600 savings with the S-Corporation option.

What could go wrong?

Reasonable compensation. What is reasonable compensation? The driver of the tax savings is reduction in payroll tax based on the amount of your W-2 wages. What if you paid yourself a W-2 wage of $10,000 rather than $90,000? That would reduce tax quite a bit. Is a $10,000 W-2 wage reasonable? What can the IRS do if they determine your reported wages were artificially low?

The IRS has the authority to reclassify distributions to an S-Corporation shareholder to wages under §7436. In addition several court cases support the authority of the IRS to reclassify other forms of payments to wages.

From the IRS website:

The key to establishing reasonable compensation is determining what the shareholder-employee did for the S corporation by looking to the source of the S corporation’s gross receipts.

The three major sources are:

- Services of shareholder

- Services of non-shareholder employees or

- Capital and equipment

To the extent gross receipts are generated by services of non-shareholder employees and capital and equipment, payments to the shareholder would properly be treated as non-wage distributions that are not subject to employment taxes.

But to the extent gross receipts are generated by the shareholder’s personal services, then payments to the shareholder-employee should be classified as wages that are subject to employment taxes.

The IRS has highlighted this issue for its FY 2020 Annual Audit Plan

Reasonable Compensation Determination in Examinations of Closely Held S Corporations and Their Shareholders (audit number: 201930010) Determine whether the IRS has implemented policies, procedures, and practices to ensure that compensation is considered in examinations of closely held S Corporations and their shareholders. (read — expect more audits on this issue)

Additional Compliance

If the S-Corporation route works for you and your business remember to setup a system to file federal and state payroll tax returns. You will also need to consider filing requirements for S-Corporation federal and state income tax returns in addition to your individual tax return.

Next steps

If your business is an S-Corporation take another look at your compensation with your tax advisor. Is your compensation reasonable? If you are structuring a new business or considering restructuring an existing business consider the keys to establishing reasonable compensation and balance the risk reward of operating as an S-Corporation including the additional compliance burden.

At AccountFWD we guide entrepreneurs and high net worth families through the intricacies of taxes and accounting. Do you have questions about S-Corporation reasonable compensation planning? Send us a note or schedule a complimentary 15 minute consultation today to find out how we can help you and to receive a personalized proposal.