Choose the Right Entity for Your Business

Entrepreneurs must pick what business entity or structure they will operate as. It’s not a simple selection because there are pros, cons, and important implications for each option. Here’s a quick rundown:

- Sole Proprietorship – You are automatically considered a sole proprietorship if you don’t register as another business entity. They are easy to set up, but since there is no division between the business and the owner, you can be held personally liable for business debts. Generally sole proprietorship income is subject to self employment taxes, including the required Medicare and Social Security contributions.

- Limited Liability Company – Easy and cheap to set up, limited liability companies (LLCs) make a business entity (and its debts) separate from the owner. Generally, profits and losses can pass through to the owner without first paying corporate taxes, but that person must instead pay self-employment taxes, including the required Medicare and Social Security contributions. LLCs also offer lots of flexibility – they can have one or multiple members and can follow different tax structures. Tax elections are available to LLCs to be treated as a sole proprietorship, partnership (multiple members), S-Corp, or C-Corp. LLCs provide a flexible framework for tax structuring.

- Partnership – Partnerships allow two or more people to easily divide their liability. General partnerships have unlimited liability; however, with limited partnerships (LPs), only one partner, known as the general partner, has unlimited liability while all the others have limited liability but less control of the business. With limited liability partnerships (LLPs), all partners share the same limited liability. Learn more about partnership draws, capital accounts, and how to get paid through a partnership.

- C-Corporation – Corporations can be more expensive to set up, and they face greater record keeping and reporting requirements. In exchange, they provide the most protection from personal liability because corporations are completely distinct entities that can earn profits, pay taxes, hold legal liability regardless of who the owners/investors are. Corporations can also raise capital through stock sales.

- S-Corporation – This business entity works much like a C-Corporation except that owners can pass through profits and losses without first paying corporate taxes on them, thereby avoiding double taxation. The drawback is that S-Corps can be harder to set up and manage compared to a similar option like an LLC. Learn more about S-Corp reasonable compensation tax strategy and requirements.

- Nonprofit – An organization must use all its profits for an approved purpose – charity, education, religious, literary, or scientific work – to register as a nonprofit. They are exempt from state and federal taxes, but nonprofits must follow strict rules (and reporting requirements) for where and how they spend profits.

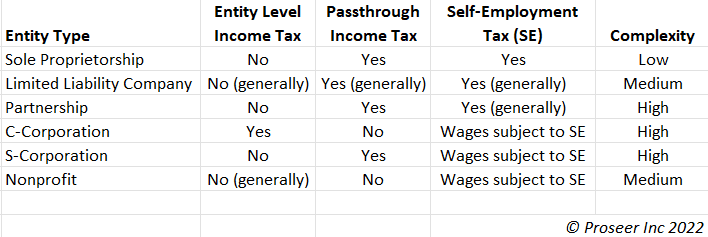

Comparison Chart

Which is the Right Business Entity?

The right choice depends on lots of different factors, from your tax liability to your growth plans. The choice of a business entity will affect how a new company gets up and running and how it conducts itself every day afterwards; it’s a massive commitment that can be difficult to change.

Don’t rush to decide. The business structure you choose will impact your operations, amount of taxes you pay and your personal liability. The right choice may be far from obvious, and there could be ways to structure a business entity with strategic advantages in mind. Get your business off to the strongest start possible – contact Proseer.