If you earn income other than W-2 wages, you will need to make estimated tax payments every quarter to avoid penalties and interest. Here’s how.

Most taxpayers prepay their taxes throughout the year as withholding or quarterly estimated tax payments. As tax day approaches on April 15th each year we calculate tax due, compare to the amount prepaid as withholding and estimated tax payments, and then send in a payment for the balance or request a refund with our tax filing. If we did not prepay enough throughout the year the IRS will issue a penalty, more on that later.

How much should I pay?

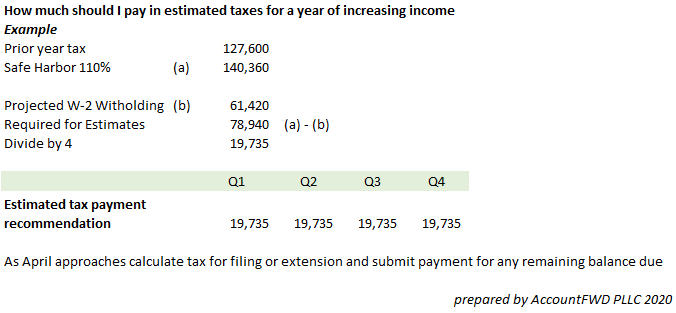

A year of increasing income

In a year of increasing income we need to pay in at least 110%* of last year’s tax. This amount is first reduced by withholding and then divided by four to represent the minimum expected quarterly estimated tax payments. A real life example is presented below.

A year of decreasing or flat income

In a year of decreasing or flat income we need to pay in at least 90% of the current year tax. This can be a challenge as it may be difficult to estimate what this year’s tax will be in the first or second quarter.

Safe Harbor

If we pay in at least 110% of last year’s tax or 90% of the current year tax we are within the safe harbor and will not be subject to underpayment interest penalties. As April approaches any additional amounts due will need to be paid by April 15th, the original due date of the return.

Many taxpayers file an extension — an extension is an extension of time to file but not an extension of time to pay — a common misconception. Required amounts not paid by April 15th may be subject to additional interest and penalties.

What happens if I don’t make estimated tax payments?

If you are required to make estimated tax payments and you don’t make them or don’t pay in enough the IRS will assess underpayment interest at the published quarterly rate. The underpayment interest rate for 2020 Q1 and Q2 was 5% and it is now holding at 3% for Q3.

It’s important to note that the interest rates are annual rates and you will only pay on the underpayment amount. This interest is also non-deductible and more expensive than deductible business interest at the same rate.

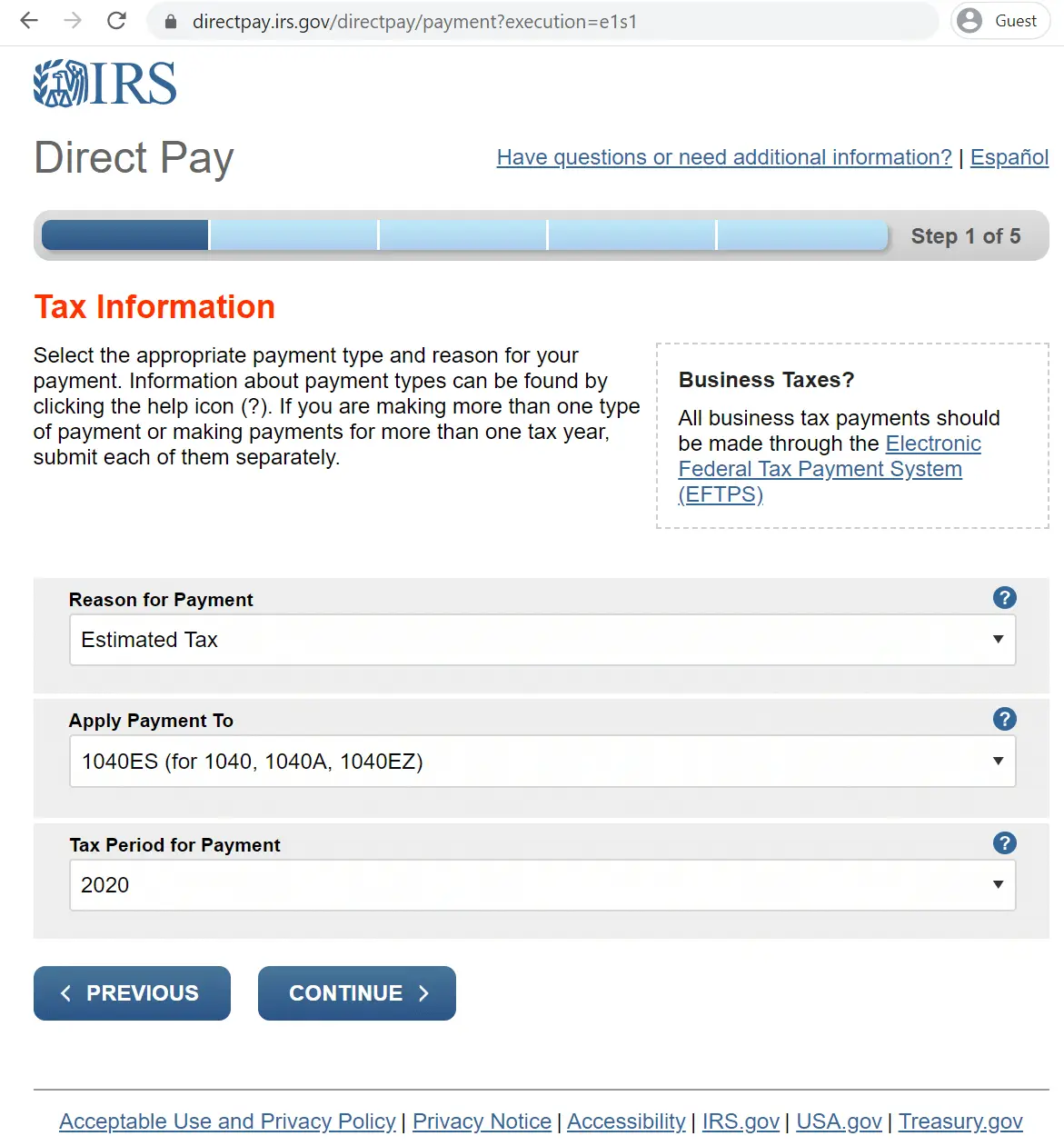

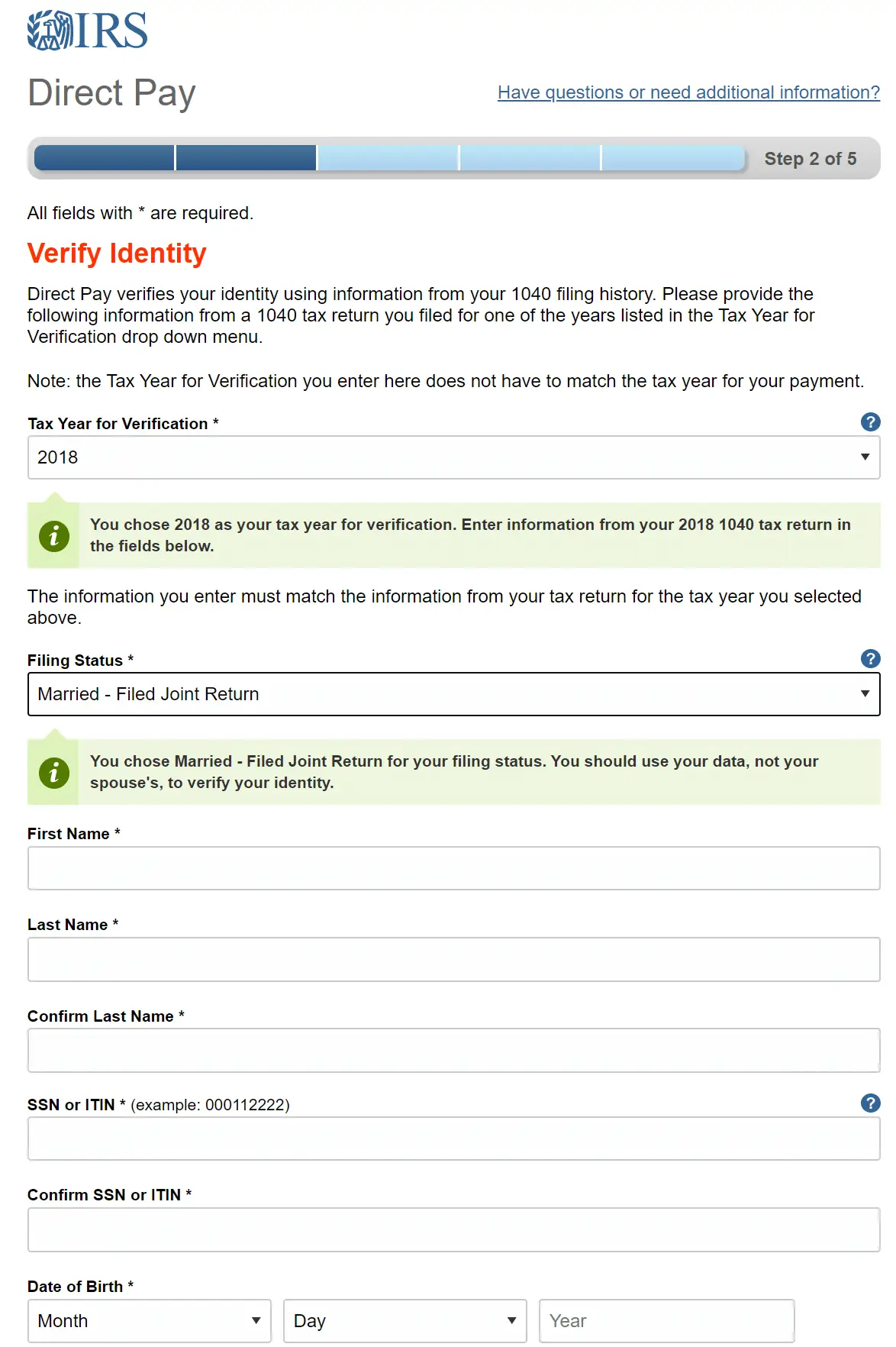

Make payments using IRS direct pay

There are many ways to make estimated tax payments but our preferred method is IRS direct pay available on the front page of www.irs.gov — click the link to “Make a Payment“. We recommend direct pay because it is easy to make a payment online with a direct debit from your checking account. You will need some information from a prior year tax return to verify your identity prior to making the payment.

Other payment options include the government’s EFTPS (Electronic Federal Tax Payment System) and mailing a check with a payment voucher.

If you are interested in more information about estimated tax for individuals you may want to visit the IRS website for form 1040-ES.

Next Steps

Please consult your tax advisor prior to embarking on your tax payment plan. Remember to consider exposure to state taxes and requirements for state estimated tax payments.

At Proseer we guide entrepreneurs and high net worth families through the intricacies of taxes and accounting. If you have questions about your taxes please contact us.

* 110% should be substituted with 100% if prior year income was less than $150,000 for a married couple filing jointly.